Markets

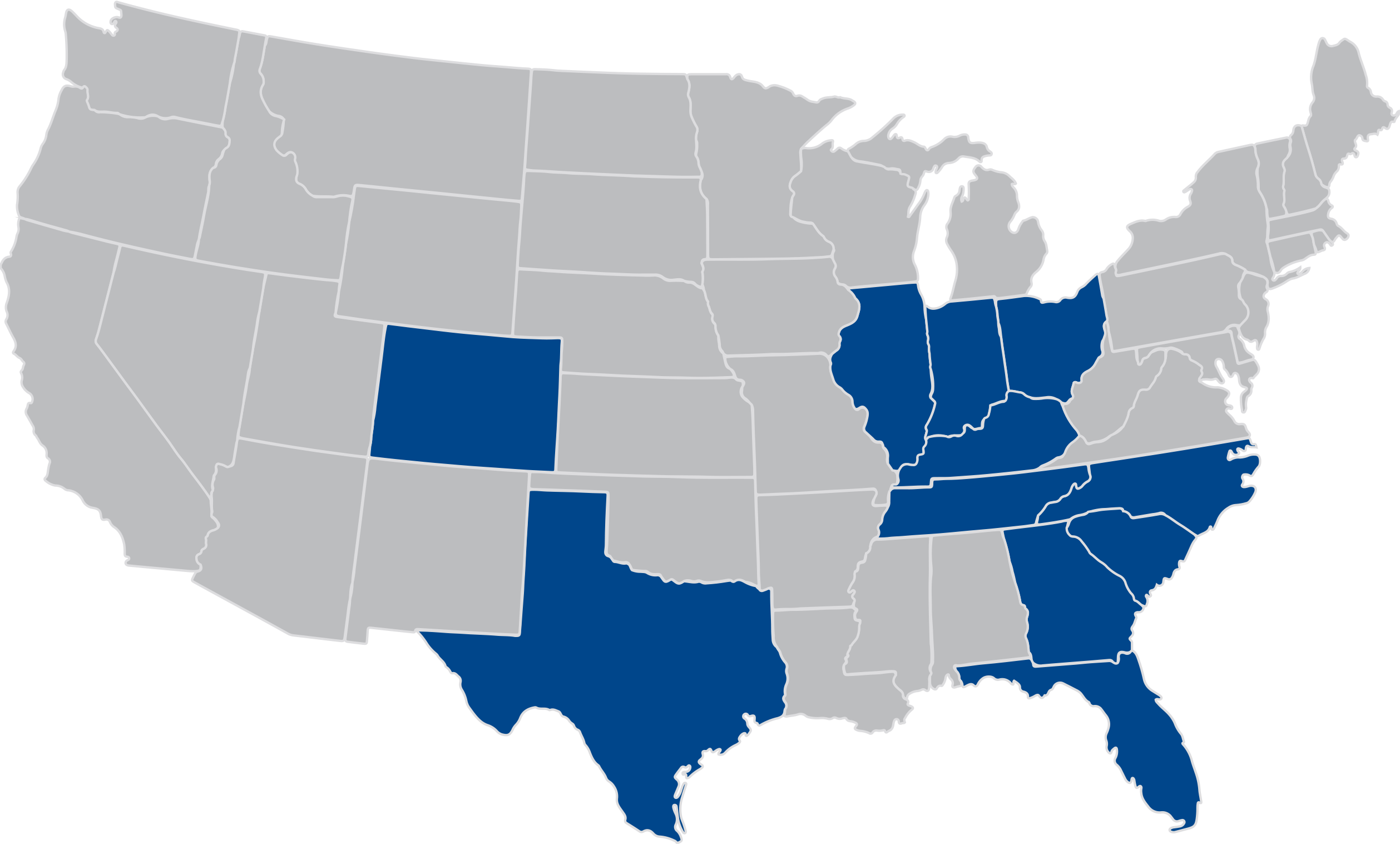

Citimark has a multi-pronged investment strategy focused on investing in infill industrial real estate and development of Class A Industrial assets in major markets throughout the U.S, as well as opportunistic investing in value add office and mixed-use projects in the Midwest and Southeast markets.

Citimark is seeking to grow its portfolio for its investors through acquisitions, development or redevelopment of existing assets. Our strategy is to build a diverse portfolio without over exposure to any single building, market or tenant in order to provide our investors with consistent, predictable returns that can be achieved through multiple real estate cycles.